Transportation and Logistics Industry – Year End Recap

-

April 08, 2022

DownloadsDownload Article

-

Global Logistics Market Outlook

The global logistics market is expected to grow at a 6.8%1 CAGR during 2022-2030, particularly due to surge in e-commerce logistics, containers shortages, closure of major ports causing port congestion, shortage of truck drivers, andrestricted capacity in the air freight market.

APAC will be the largest logistics market globally, holding ~45% of the total market share, and is expected to outperform other regions in the future due to positive outlook for emerging economies in the region. Asia is expected to contribute ~50% of global trade growth by 2030.

Impact of E-commerce Growth

With the omnichannel approach to e-commerce retail gaining ground, it has become imperative for logistics providers to adopt automation and newer technologies such as AI, geo-fencing, IoT, and data analytics to make the delivery and returns experience seamless and cost-effective for both customers and retailers. Rising adoption of analytics-powered dynamic route planning systems is facilitating logistics companies in optimizing operations and providing cost-effective and seamless experience to both customers and retailers.

Impact of Russia’s Assault on Ukraine:

- The conflict has disrupted the supply of key raw materials. Crude oil has surged past $100 a barrel, resulting in the U.S. and other countries releasing oil form their emergency stockpiles.

- Freight has been re-routed, derailed, and suspended from surrounding areas disrupting the global supply chain network.

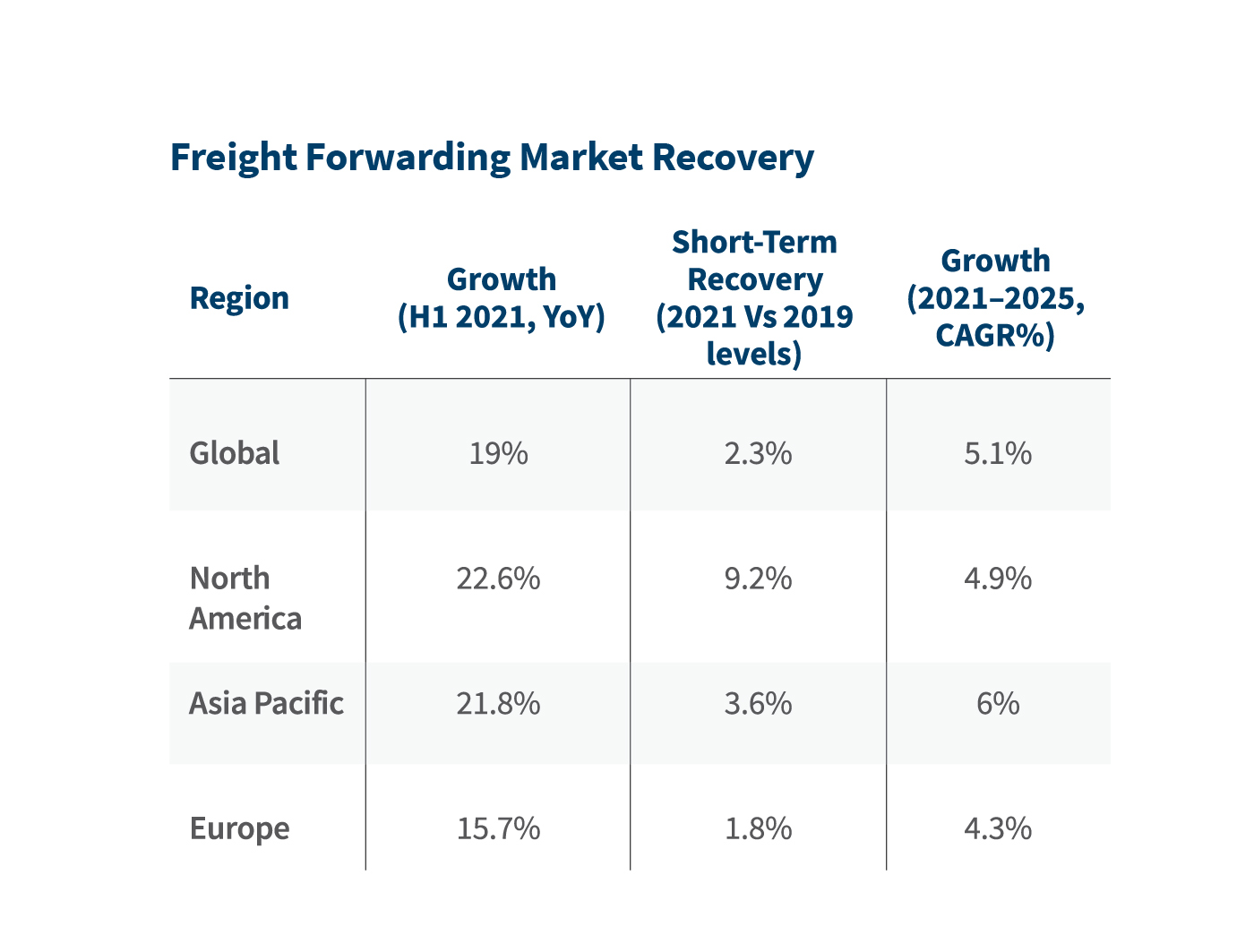

Post-COVID-19 recovery will continue in 2022, picking up pace over the next 2–3 years

Economic Outlook

Despite the threat of the Omicron variant, the near-term outlook for the global economy is positive; real GDP growth is expected to continue above 3.9% Y-o-Y in 2022, driven by continued expansions in the U.S. and Asia4.

Ongoing pandemic-related delays and closures, high demand for ocean freight from Asia to the U.S., and capacity constraints have resulted in high rates and unreliable transit times for both air and ship freight, but resumption of full operations at China’s Yantian airport will ease pressure on the logistics industry.

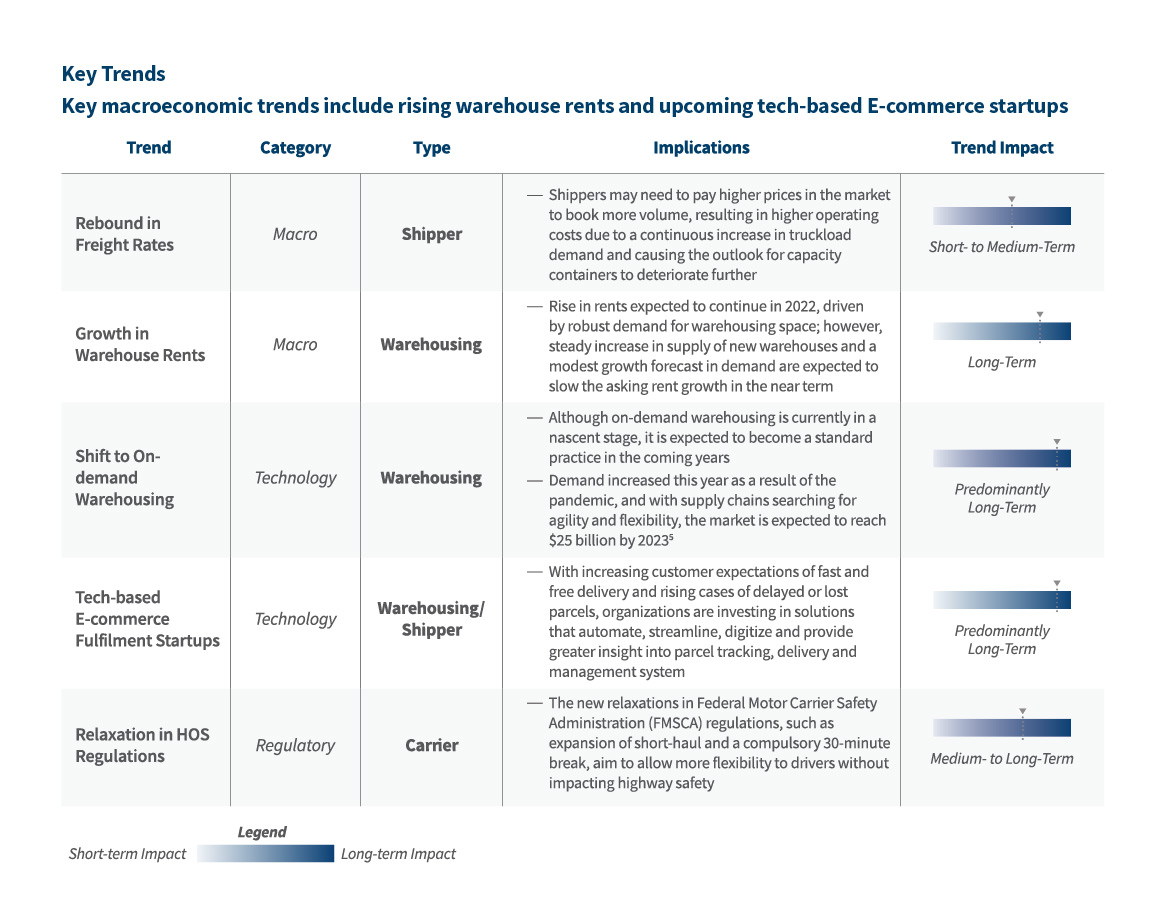

Freight Rates

Strong consumer demand, new pandemic-related restrictions and the lack of container capacity, expected to continue during 1Q22, will likely keep freight rates high across all geographies.

ESG Risk Framework

Amid mounting pressure from customers, employees, regulators, and investors, T&L providers are prioritizing the adoption of more sustainable processes to align with evolving market realities and to gain competitive edge, however, there are only few companies that have internalized these processes.

Workforce Diversity

Workforce diversity within the Transportation & Logistics (T&L) industry lags significantly, when compared with other industries; hence, industry players (such as DHL, Maersk, and XPO Logistics) are prioritizing the adoption of policies that ensure diversity and inclusion within their workforce.

Challenges

Shortage of shipping containers (“Black Swan” event) is emerging as a serious concern as the demand for Asian exports increased strongly, filling all available vessel capacity and leaving equipment stranded in the U.S. and EU.

Port congestion, particularly along the U.S. West Coast, has turned out to be a major issue for shipping companies, as ships now must wait longer to get unloaded, which results in higher costs.

With the demand for logistics services growing and the pandemic-led labor shortage, there is increasing pressure on the supply of labor, particularly in the trucking industry, which is facing a major shortage of drivers.

Investments and Bankruptcies

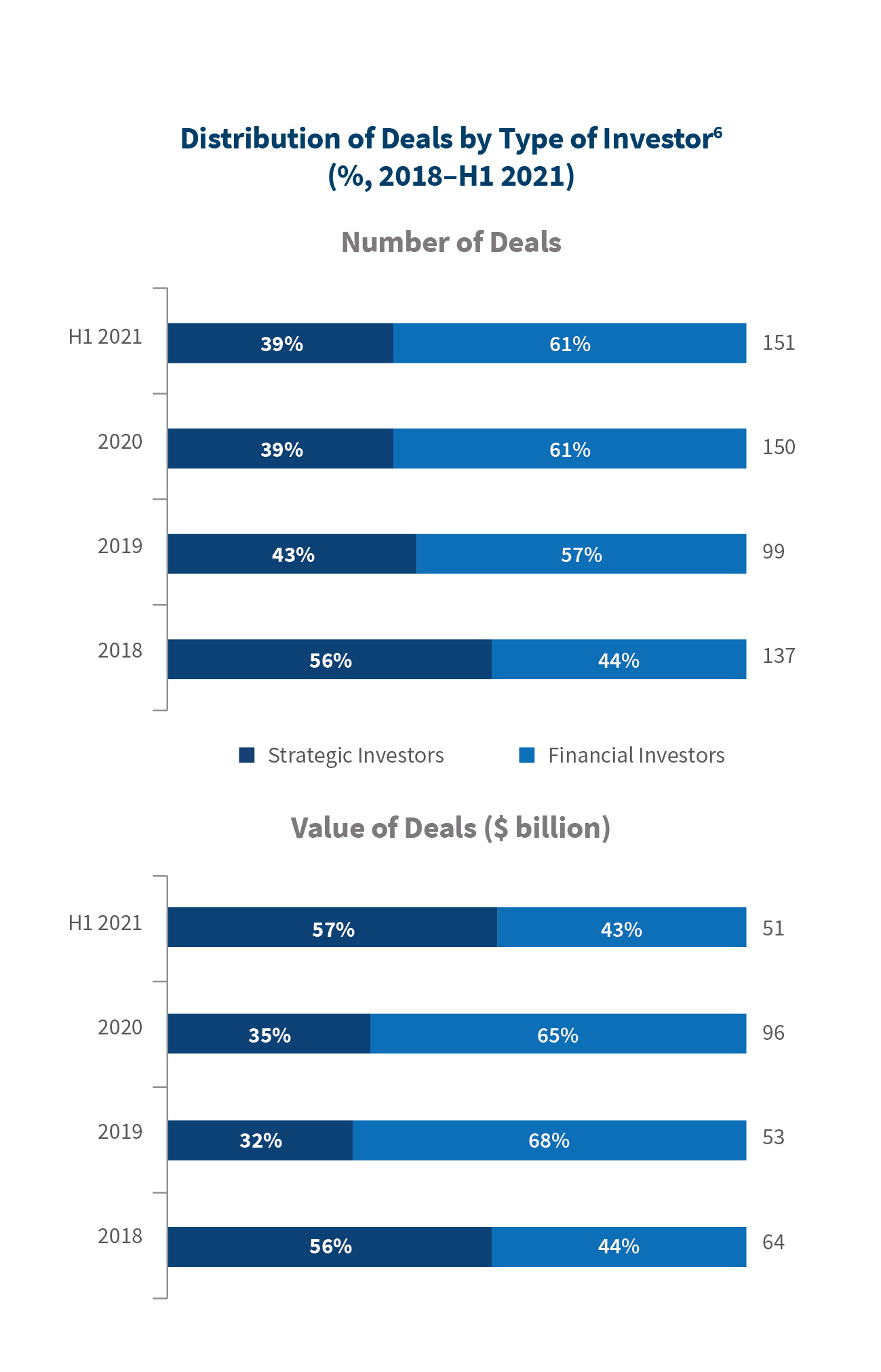

M&A Trends: Deal value through November 15, 2021 grew 84% compared to the previous year, mainly driven by deals in the logistics, rail and passenger air sectors. Growth in deal volume increased by 11% as compared to FY20 due to an increase in deals in the vehicle rental/leasing, logistics and trucking sectors.

Private Equity (PE) Investments: PE firms witnessed 21.9% increase in deal values during the first five months of 2021, leading to a total of 2,346 deals.

PE firms are raising money faster on account of rise in the number of funds and institutional investor allocations; this led to an all-time high in dry powder of $920 billion in October 2021.

Bankruptcies: Instability from the pandemic led to high volatility in demand, price and capacity, resulting in thousands of truck carriers going bankrupt, a fall in intermodal demand, and the number of rail carloads declining by 12%.

~3,000 trucking companies were forced to shut down business in 2020 due to pandemic, compared to 1,000 in 2019.

Footnotes:

1: menafn.com

2: weforum.org

4: msn.com

6: Investor groups are counted as financial investors.

Related Insights

Related Information

Published

April 08, 2022

Key Contacts

Key Contacts

Senior Managing Director, Leader of Food, Agriculture & Beverage

Senior Managing Director

Senior Managing Director